Gold Price Analysis: XAU/USD stays firmer on the way to $1777 hurdle – Confluence Detector

Gold consolidates the latest two-day downtrend amid a quiet Asian session on Monday. That said, the yellow metal picks up bids towards refreshing the intraday high around $1,774 while flashing 0.30% gains on a day by the press time.

While the US dollar strength and risk-off mood could be traced for the yellow metal’s earlier south-run, the recent gains seem to take clues from S&P 500 Futures, up 0.40% intraday.

The hopes of US stimulus and economic recovery in Asia, despite the looming coronavirus (COVID-19) in Japan and India, back the risk barometer. However, off in China and Japan, coupled with a light calendar elsewhere, seem to restrict the market moves.

Moving on, US activity numbers for April will be the key as traders will wait for confirmation of the recently strong economics published from the world’s largest economy to extend the market optimism.

Read: US Purchasing Managers’ Index April Manufacturing Preview: Let the good times roll

Gold: Key levels to watch

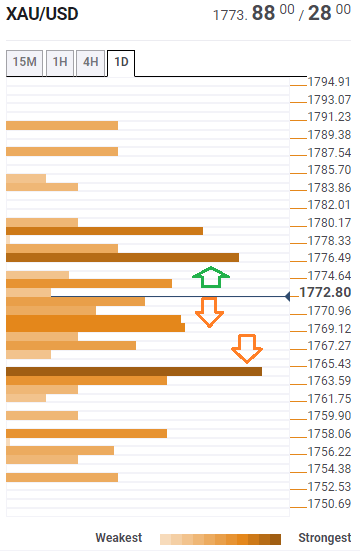

The Technical Confluences Indicator suggests the bulls are tightening the grips above the $1,765-64 support convergence including first support of Pivot Point on the Daily (1D) chart, 23.6% Fibonacci retracement on the weekly (W1) play and previous low of 1D.

While the upward trajectory has legs, backed by the recent risk-on mood, SMA 5 and 23.6% Fibonacci Retracement of monthly 1M chart intersect, around $1,777 becomes a tough nut to crack for the gold bulls.

Even if the bullion buyers manage to cross $1,777, a joint area comprising SMA 10 on daily, SMA 50 on four-hour (4H) and SMA 200 on the hourly chart (1H), not to forget second resistance on the daily Pivot Point, offer an additional filter to the north.

It should, however, be noted that the clear run-up beyond $1,780 will give a free hand to the gold buyers targeting the $1,800 threshold.

Meanwhile, multiple Simple Moving Averages (SMAs) on the short timeframes join Bollinger to highlight the $1,770 as immediate support ahead of the $1,765-64 key levels.

In a case where the bright metal drops below $1,764, an area comprising mid-March tops and late April lows near $1,755-56 will be the key to watch.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.